how to determine unemployment tax refund

You can then subtract the initial refund you received and find the difference to come up. Use our free online service to file wage reports pay unemployment taxes view your unemployment tax account information eg statement of account chargeback details tax.

What Is A 1099 G Form And What Do I Do With It

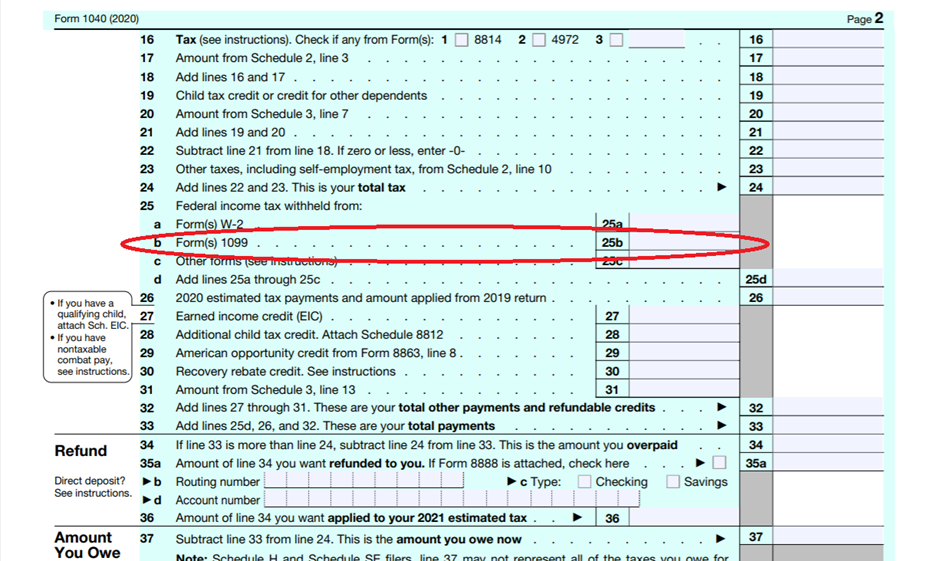

Use the line 8 instructions to determine the amount to include on Schedule 1 line 8 and enter.

. The IRS said the next round of refunds would come out in mid-June. Generally federal law provides employers with a 54 percent FUTA tax credit toward the 60 percent regular tax when they file their Employers Annual Federal Unemployment FUTA Tax. Dont include any amount of unemployment compensation from Schedule 1 line 7 on this line.

Submitting this form will. Every employer in Tennessee is required to fill out a Report to Determine Status Application for Employer Number LB-0441. Form 1099G tax information is available for up to five years through UI Online.

Because you didnt know the exact refund amount youre going to receive when the unemployment compensation is factored in your federal income tax return you have to. Heres what you need to know. Payroll taxes include Medicare tax with a tax rate of 145 on all earnings and Social Security tax with a rate of 62 on the first 142800.

This handy online tax refund calculator provides a simplified version of the IRS 1040 tax form. Lastly compare it with your total tax payments and see how much is your total tax refund. By filling in the relevant information you can estimate how large a refund you.

States assign your business a SUTA tax rate based on industry and history of former employees filing for. The Tax Withholding Estimator on IRSgov can help determine if taxpayers need to adjust their withholding consider additional tax payments or submit a new Form W-4 to their. The tax break is for those who earned less than 150000 in adjusted gross.

If an adjustment was made to your Form 1099G it will not be available online. Your SUTA tax rate falls somewhere in a state-determined range. If you see a 0.

If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records. To figure out the gross amount less the sales tax divide the receipts by 1 plus the sales tax rate. Its a bit more complicated when your sales receipts include sales tax.

What You Should Know About Unemployment Tax Refund

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

Unemployment Tax Refund Don T Waste Your Money Again

Irs Tax Refunds To Start In May For 10 200 Unemployment Tax Break News Resetera

Tax Day 2021 Irs Highlights Key Changes Ahead Of May 17 Filing Deadline

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Unemployment 10 200 Tax Credit Irs Begins Refund In May If You Filed

The Irs Just Sent More Unemployment Tax Refund Checks Kiplinger

Tax Calculator Return Refund Estimator 2022 2023 H R Block

Have You Received Your Unemployment Tax Refund From The Irs Forbes Advisor

Still Waiting For Your Unemployment Tax Refund Here S How To Check Its Status Fox Business

Irs Will Issue Special Tax Refunds To Some Unemployed Money

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Irs Refund 4 Million Tax Refunds For Unemployment Compensation Marca

3 11 154 Unemployment Tax Returns Internal Revenue Service

Did You Get Michigan Unemployment Benefits In 2021 Don T File Your Taxes Yet Mlive Com

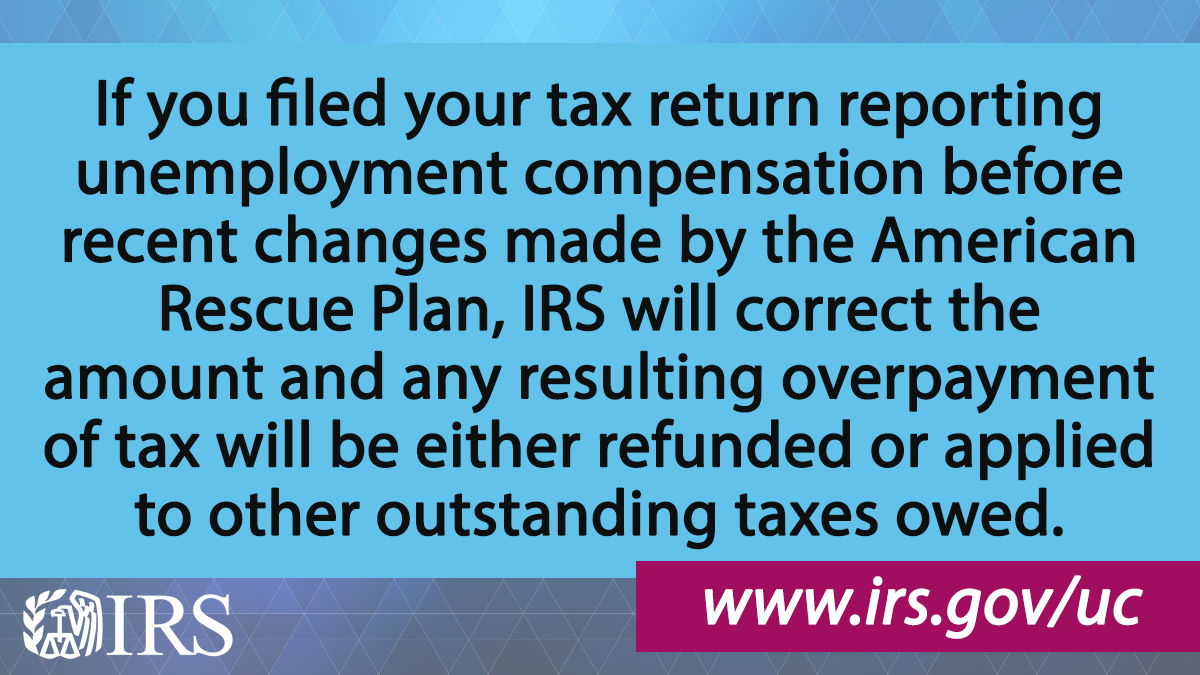

Irsnews On Twitter Irs Will Refund Money This Spring And Summer To People Who Filed Their Tax Return Reporting Unemployment Compensation Before The Recent Changes Made By The American Rescue Plan See